Your PCGS Solution is built on a World-Class Ecosystem, customized for your firm and your individual LPs

PCGS reaches into an Ecosystem, that serves the largest firms and investors in Canada – the ecosystem that comprises Canada’s Group Investment industry.

Why the Group Investment Industry? Because it combines the buying power of Canada’s largest firms, with your own, to access traditional institutional investment managers, on the best possible terms, supported by the very best technology, in a Platform specially curated for your firm and your LPs.

PCGS brings the power of this unique solution to Private Capital firms across Canada.

State of the Private Capital Market Today

The private capital market is a cornerstone of the Canadian economy, yet a significant challenge persists within its model…

For every successful fund, there are too many Limited Partners who are underperforming, and leaving serious money on the table while they await Capital Calls

This is frustrating, and it doesn’t need to be this way.

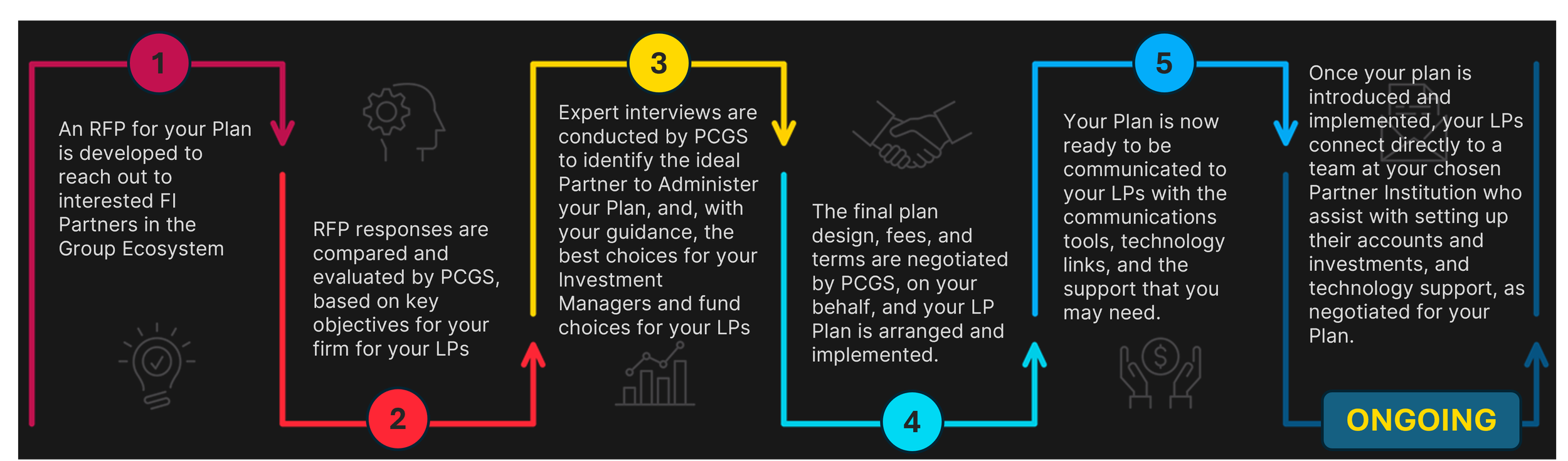

How It Works

Creating Your Tailored Solution - Your Platform, a Group Plan for your individual LPs

The PCGS Approach is designed to be simple and effortless for you.

And most importantly, there is no cost to your firm – the Group Industry model ensures that the cost is borne by your chosen Platform Provider and their institutional investment partners.

Who are the Financial Institutions in this Ecosystem?

These are some of the major Financial Institutions that compete to administer group plans, and ultimately from whom you will chose, as your chosen Partner for your firm’s Group Plan.

-

We collaborate with major banking institutions known for their stability, security, and extensive resources. This ensures a foundation of unwavering trust and reliability.

-

We partner with top insurers who have decades of experience managing large-scale group savings and retirement plans. Their deep expertise in long-term financial stewardship is core to our model.

-

To ensure a modern and seamless user experience, we align with cutting-edge digital financial platforms that specialize in intuitive, user-friendly wealth management technology.

-

Recognizing the unique financial landscape of Quebec, we partner with established, provincially-focused institutions to deliver solutions that are perfectly aligned with local regulations and client needs.

Who are the Investment Firms in this Ecosystem?

These are just some of the investment firms that offer the underlying investment funds and products which are curated for your Plan. They are among the best in Canada and indeed from around the world among traditional asset managers.

What are the available investment products and choices for your Plan?

There are literally dozens and dozens of institutional products and funds available in this ecosystem, to choose from. Typically, 10-12 is the right set of choices for your LPs, given the shorter time horizons and liquidity needed for Capital Calls.

What does PCGS do in all of this?

PCGS manages all aspects of the design and selection process for your Plan Partner, and your Investment choices, negotiates the terms and fees on your behalf, coordinates your Plan implementation, and oversees its Compliance and ongoing success.

So, at the end of the day, you have an Investment Platform, specially curated for your LPs, which leverages their group buying power and yours, to access top institutional funds, lower fess, great technology, and the peace of mind of knowing that their money is working hard while it is on stand-by for your Capital Calls, as it should be..